Published by Paydock •

Payments orchestration as a concept may not be new but its role within the global payments ecosystem is becoming increasingly crucial as merchants try to keep up with an ocean of payments options. Powered by rapidly changing consumer demands, the rise of ecommerce and a race to the bottom in transaction fees, orchestration is about to hit prime time.

While giving options to customers may be the way forward for merchants looking to increase sales and make the most of ecommerce, the downside is that it essentially creates a headache from logistical, integration, efficiency, and cost point of view.

We outline the top reasons why merchants should seriously consider payments orchestration in order to stay in the game while making the most of the ecommerce opportunities.

1. Scale faster and serve a global audience

Digitisation and ecommerce are globalising many businesses, however, optimising a payments strategy globally on a single payment gateway is almost impossible.

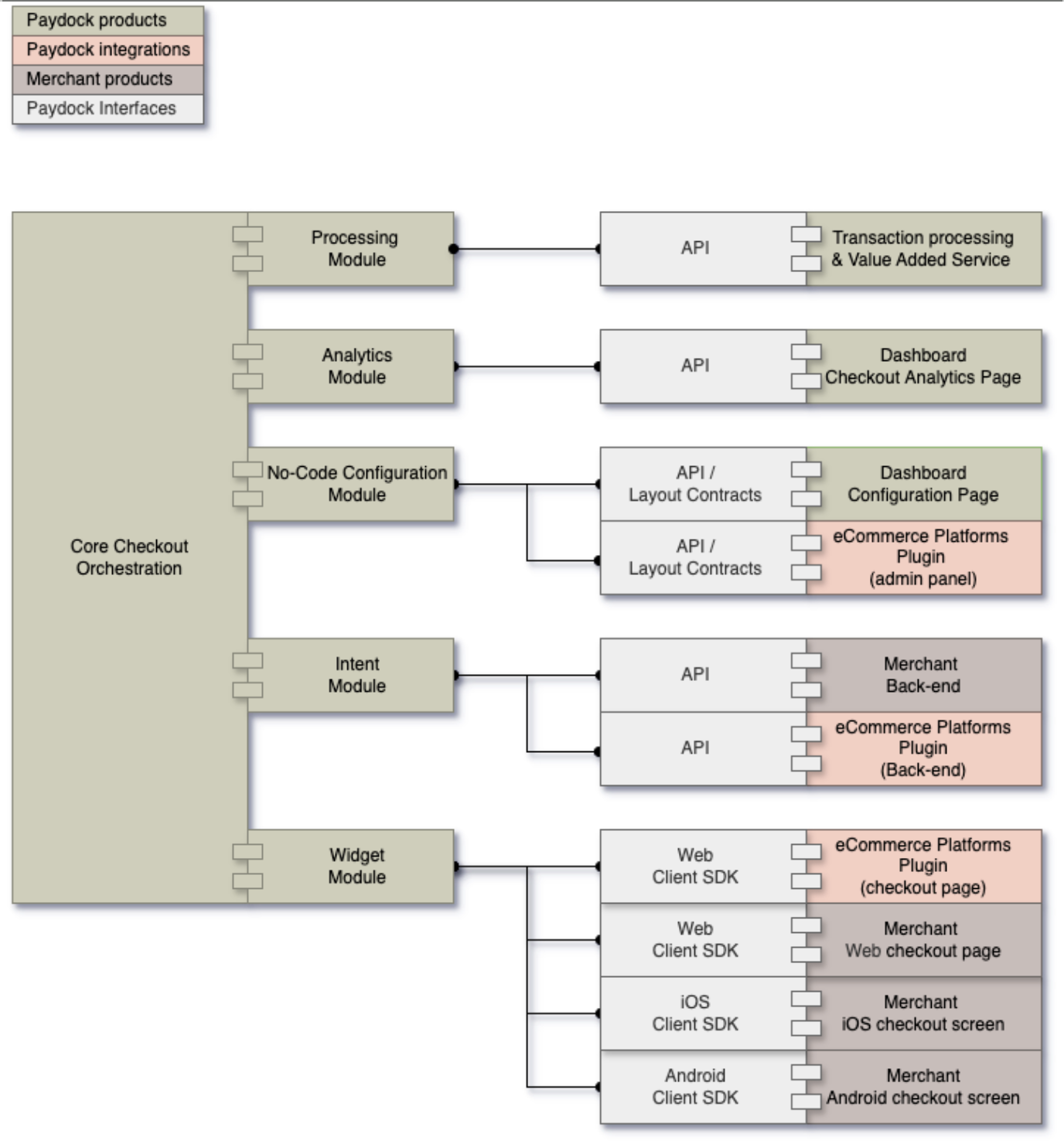

Through payments orchestration, merchants can up their game on a global scale by being able to integrate various payment providers and orchestrate the entire transaction process from end to end, starting from checkout to processing, acceptance, reconciliation, recording and reporting.

From a cross-border point of view in particular, it means that merchants can be smart with routing and integrate the right mix of regional and global payment providers to optimise acceptance rates and save costs.

Paydock’s payments orchestration platform enables merchants to plug in unlimited gateways globally and yet remain in total control.

Adding a new payments service through Paydock’s platform takes seconds, merchants can engage a broader consumer base and effortlessly expand to new geographies and markets – all the while knowing that they are in charge of the whole process. Paydock’s payment orchestration service can support hundreds of processors around the world through a single API.

2. Fail proof and highly resilient payments ecosystems – where things always go your way

Payments orchestration can also facilitate a better failover process for transactions by enabling the system to automatically and intelligently reroute to the next best alternative payment method in the event of failed transaction and thus secure a better chance of transaction success rate.

Since adopting an orchestration-first approach, Paydock has recorded reductions in administration and technical costs by as much as 70% when using our platform.

Not only does this reduce cost per payment that a merchant has to bear, it also ensures that no sale is lost and customers remain satisfied, making payments orchestration a very appealing ROI proposition for merchants.

For example, Paydock’s real-time routing engine enables merchants to build a suite of configurable routes in an “if-this-then-that” arrangement, removing the need for an IT project full of anxiety and additional cost. So not only does it make sense to merchants thinking ahead, it also has a real and instant bottom-line impact.

Add to this the ability of a merchant to mitigate risks associated with payment processor downtimes – something that can easily happen in the complex payments world!

3. Fraud protection

Just as merchants are looking to capitalise on the rise of ecommerce, fraudsters are hard at work too. According to Finder, in the first half of 2020, there was a reported loss of almost £30m attributed to online shopping and auction fraud. With this number expected to continue to grow and businesses constantly coming under attack, risk is increasing and fraud protection has become a priority focus for merchants who seek to harden their security posture.

“In the first half of 2020, there was a reported loss of almost £30m attributed to online shopping and auction fraud”

Without payments orchestration, the transactional data is spread over multiple gateways and payment providers, therefore it is naturally hard to have insight into or indeed analyse data, making fraud even harder to detect. Well, guess what? Risk is one of the areas where payments orchestration has a tremendous value and could particularly be effective against fraudsters too, but aggregating and processing all data in one place, giving you real-time visibility and analytics at your fingertips.

And while on the subject of visibility, check out Paydock’s Audit Tool which gives auditable visibility of all activity in real time across the Paydock ecosystem. This allows merchants to monitor all gateways, users and updates all within the Paydock network. This is available in Paydock’s multi-user engine, so merchants can track actions of their staff, external developers and third party integrations.

4. Futureproof

An increasing need and therefore demand for payments orchestration, already being used across numerous industries, is indeed an indication that it is here to stay, so merchants need to think long term. While there are a myriad of initiatives that offer a temporary fix and lift in revenues and profitability, payments orchestration is really all about the bigger picture – it is about enabling businesses to future proof themselves by allowing them to plan, prepare and adapt to the rapidly changing payments landscape and whatever it may bring next.

Payments orchestration is a scalable, robust and cost-effective solution to end-to-end payment processing, with easy access to continuously growing payment methods and alternatives, which will be a commercially significant aspect for merchants and therefore crucial for their success.

5. Improve customer journey and conversion rates

This is probably the most critical benefit of payments orchestration as by simplifying the entire process it removes many obstacles to successful completion of a transaction, while flexibility and a choice of payment methods help merchants meet customer preferences and expectations leading to improved conversion rates. According to 451 Research, 78% of consumers say that if their preferred payment method isn’t accepted, they are less likely to shop with that business in the future.

“78% of consumers say that if their preferred payment method isn’t accepted, they are less likely to shop with that business in the future.”

The checkout experience is probably the most debated area for many merchants with many thousands of pounds and hours spent on designing, re-designing, and testing. The real beauty and advantage of payments orchestration is that it completely removes these complexities and enables merchants to offer a smoother journey to their customers by giving them the payment methods and options regardless of where they are.

Payments orchestration is truly a no-brainer for merchants to adopt worldwide.

By introducing an orchestration-first strategy as a default, merchants are able to rapidly consume and capitalise on all the market has to offer without any of the traditional costs. With the ability to future-proof, scale faster whilst reducing compliance creep, payments orchestration is truly a no-brainer for merchants to adopt worldwide.

To find out how Paydock can help pocket more for your business, speak to one of our friendly team today by dropping us a line to support@paydock.com