Published by Paydock •

Merchants today are expected to offer not just one, but multiple Buy Now Pay Later (BNPL) options at checkout or miss out on sales. Yet with continual shifts in popularity, price and convenience – understanding which BNPL to select and then solving the complex technical, reconciliation and compliance linkages behind the scenes has become an industry-wide headache.

Buy Now Pay Later options at online checkouts have accelerated rapidly within the last few years, with 10 million customers now having used a BNPL product to purchase goods online in 2020 (Capital Economics, 2021). These payment options, initially popular amongst the millennial and Gen Z consumers, have now become one of the fastest growing payment methods set to take over the traditional forms of credit.

Given that 9.5 million consumers in the UK actively avoid buying from retailers that don’t offer BNPL (Paypers, 2021), it is pivotal merchants offer BNPL methods at checkout in order to engage their markets. By incorporating BNPL solutions into their payment strategies, merchants can tailor their offer to the needs of their consumers whilst attracting customers, maintaining or increasing repeat customers and enabling higher conversion rates.

The rise of ecommerce and the phenomenon of alternative payment methods in 2020 has fuelled the success of Buy Now Pay Later. BNPL provider AfterPay, saw a 97% revenue growth within the last year (Afterpay, 2020) and with an increasing number of providers following suit, the competition within the Buy Now Pay Later space is intensifying.

While great for the consumer, this has increased the challenges for a merchant seeking to interoperate and keep costs low. Merchants are becoming increasingly frustrated with the laundry-list of expected options, expenditure of integration and maintenance costs as they pivot from single to a genuinely flexible multi-vendor payment strategy.

Payments Orchestration is the only known method to ease this frustration.

Payments orchestration is the only known method to ease this frustration, consolidating multiple BNPL services into one unified, low or no-code service eliminating complexity and chaos and allowing merchants to focus back on core business, but now with more customers.

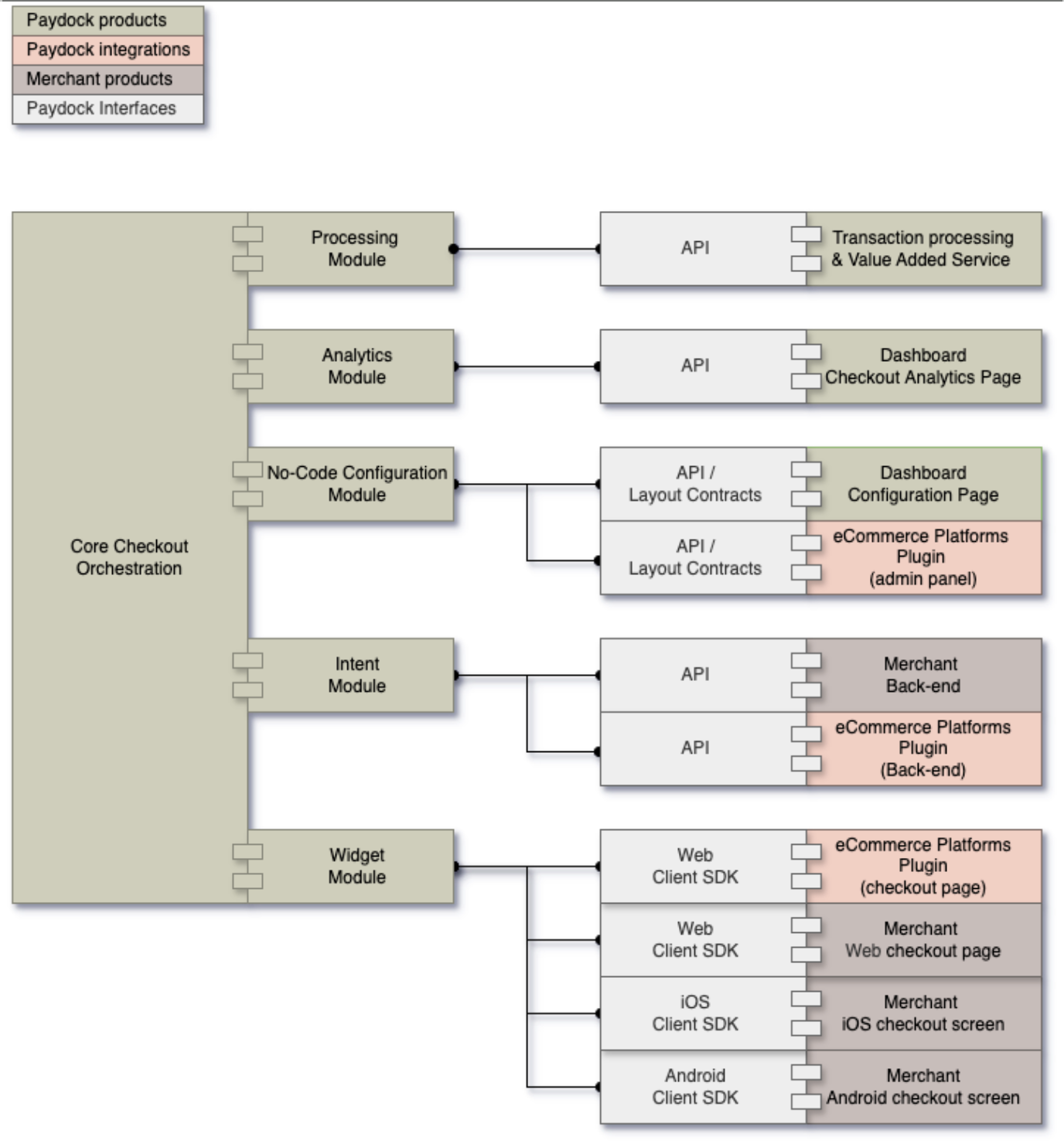

No-Code Payments Orchestration Solution.

Paydock provides a no-code payments orchestration solution through which merchants can seamlessly integrate and connect with multiple BNPL products such as Paypal’s Pay in 4, Afterpay and zipMoney effectively resolving this challenge. Merchants can accommodate consumer needs, support multiple BNPL vendors at once, and stay agile as the market moves along.

The specific costs that merchants seek to remove include hidden and variable vendor fees, complexity and costs associated with integration, maintenance and administration. Orchestration with Paydock sits at the forefront of supporting both merchants and the BNPL industry with the following benefits:

- Low cost of adoption – Plugging in an unlimited number of any payment services via one API results in a substantial reduction of software development overheads. Through Paydock’s single integration capability, merchants are able to eradicate the cost and time wasted on integrating gateways individually and access a multitude of payment gateways seamlessly. Providing a focused and dynamic payment experience irrespective of payment type and method.

- Lower cost of maintenance – When maintaining a payments strategy with multiple vendors, it’s crucial that costs are kept to a minimum. Merchants can make a significant reduction in costs associated with payments administration simply by being able to control, manage and audit all transactions via one dashboard. Paydock’s reporting API ensures that a merchant has a complete transactional and event history across its payment ecosystem, keeping them in control of their payments.

- Flexibility to move with the market – The payments sector is rapidly changing and can often limit those to feel trapped in their strategies. As the Buy Now Pay Later space increasingly becomes a primary source of payments, merchants want to feel confident that they have the flexibility to move with the changing landscape. With Paydock’s orchestration, there is no loss of grip on the customer, merchants can future proof their strategies knowing that with Paydock, they can enjoy any future payment service they see fit for their purposes.

Customer’s needs may be rapidly changing but Buy Now Pay Later is here to stay.

As this space continues to grow and competition continues to intensify, merchants want to provide their customers in the most efficient way whilst ensuring their strategies are one step ahead. Payments orchestration with Paydock resolves merchant’s needs for simplicity and flexibility within their payments infrastructure and is leading the way in resolving numerous costly issues faced by merchants seeking to navigate disparate, fast-moving and fragmented BNPL (and many more!) service providers.

To find out more about how you can win by integrating and offering multiple payment service providers to consumers in a single service, please drop us a line at hi@paydock.com.