Blog article published on Paydock.com. View original article here.

In today’s fast-paced market, merchants must adapt quickly to new payment methods, shifting customer preferences and important compliance and security demands.

This is where Paydock’s Checkout comes in—a revolutionary orchestration service that defines the future standard of payment acceptance.

By simplifying and streamlining the integration process, it reduces complexity, allowing merchants to introduce new payment options and adjust to market demands with 100x greater speed and efficiency.

But before diving into how this feature works, I wanted to first explore two key challenges we addressed when designing Paydock Checkout and at a high level how how we solved them, learning from nearly a decade of frontline experience.

Speed to Market

Time and effort required for integration are paramount for merchants, as is the appetite to be increasing security, resilience, analytics and of course, competitive advantage.

Combined with the variety of payment methods and the need to support them across various platforms heavily influence the speed and resource needs of integration.

As part of designing Paydock Checkout, drawing on years of knowledge and first-hand experience, we realised that it was critical that we find new ways to drive service adoption and modification effort to effectively zero.

Speed of Response

The ability to quickly understand and make changes to a payment environment impacts not only market changes but also security and resilience.

We have seen three primary drivers of this need over the years.

- Desire to analyse end-to-end (E2E) payment processes to gain insights into user behaviour and adapt processes.

- The capability to rapidly introduce new payment options as they emerge.

- Adjusting payment flows in response to business changes for cost efficiency.

We knew, that as part of this experience, it was critical that merchants also maintain total visibility of consumer engagement across their checkout journey.

A final comment needs to be made about security. Even ‘low-code’, while an improvement on a typical modular API-driven integration suite was not as effective as a genuine no-code solution.

We also need to bear in mind the critical importance of security, often differing across platforms, potentially complicating security management.

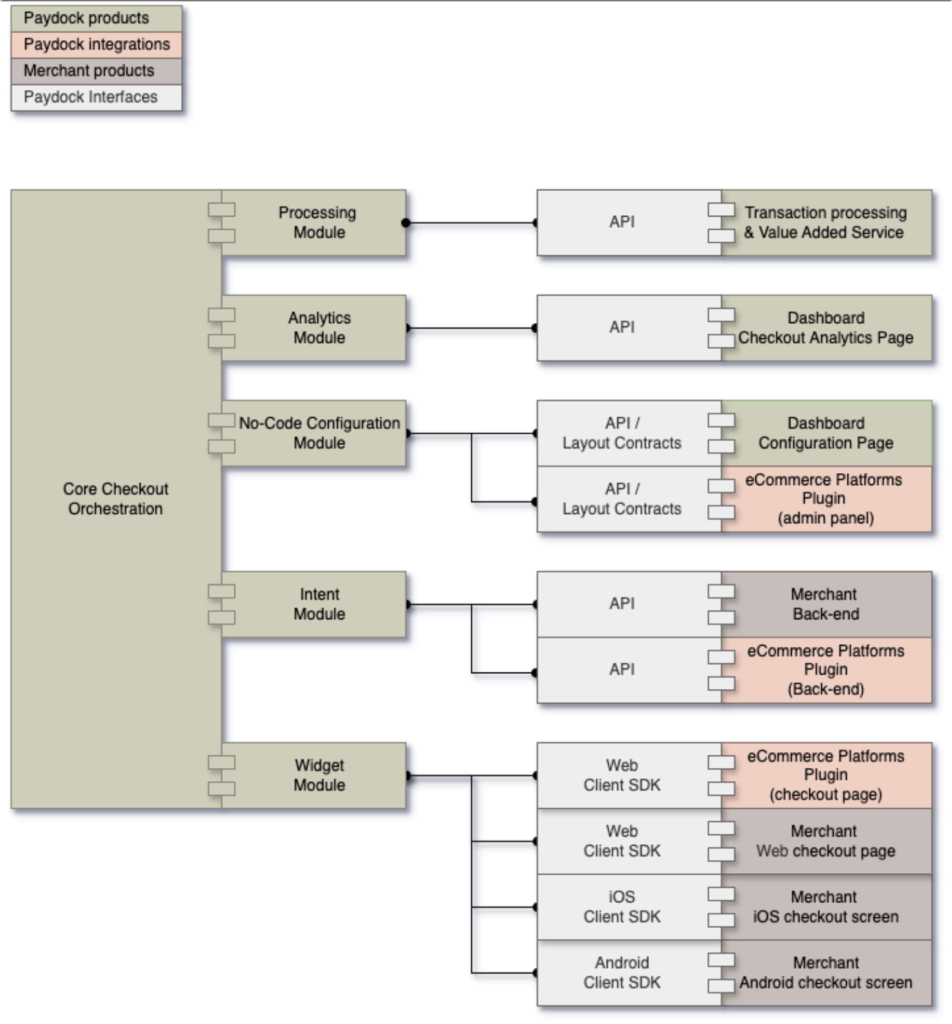

Consider, for example, a merchant system comprising web applications, mobile applications, e-commerce systems, and a backend. Payment flows traverse these components, and the merchant can exert control over the process.

The quantity of integration points and components involved affects how quickly the business can respond to market shifts, depending on the merchant’s available resources for technical adaptation.

In summary, the speed of integrating payment systems and responding to market changes depends on the resources available to merchants.

These resource requirements grow with the variety of payment options, payment flows, and platforms that need to be supported.

Paydock Checkout was specifically designed to intentionally address each of these challenges, equipping in an elegant way merchants to streamline their integration processes and adapt more efficiently to market demands.

[view original article for more]Paydock is a HyperKu portfolio company. HyperKu is an investor and has been active in assisting the company in various finance, capital, structural and management matters along the journey.